Holiday Let Mortgages: Everything You Need to Know

Investing in a holiday let property can be a fantastic way to generate income and enjoy personal holidays. Whether you’re exploring holiday let mortgages, a buy to let holiday home mortgage, or searching for competitive holiday let mortgage rates, understanding your options is crucial for making an informed decision.

What Is a Holiday Let Mortgage?

A holiday let mortgage is a specialised financial product designed for properties rented out as short-term holiday accommodations. These differ from buy to let mortgages, which are tailored to long-term tenants, by addressing the unique income patterns and management needs of holiday rentals.

Key features of holiday let mortgages include:

Higher Income Potential: Holiday lets often yield higher weekly rents during peak seasons compared to long-term rentals.

Flexibility for Personal Use: Most lenders allow personal use of the property for up to 90 days a year.

Seasonal Income Patterns: These mortgages are designed to handle income fluctuations across high and low seasons.

Who Can Apply for a Holiday Let Mortgage?

Applying for a holiday let mortgage requires meeting certain lender criteria. Here’s what lenders typically look for:

Property Location and Suitability

The property should be in a desirable holiday destination and suitable for short-term letting. Coastal, rural, or popular tourist spots often meet these requirements.

Financial Stability

A good credit score and proof of income are essential. Lenders may also ask for a projected rental income report from a letting agent.

Experience in Property Management

While not always mandatory, having experience as a landlord or property manager can strengthen your application.

Minimum Rental Income

Lenders often specify a minimum rental income requirement based on the property’s projected earnings.

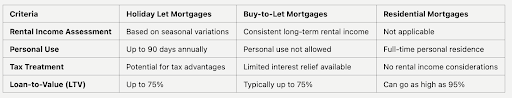

Holiday Let Mortgages vs.

Buy-to-Let Mortgages vs Residential Mortgages

While similar in some respects, multi-unit freehold block mortgages differ from HMO mortgages.

Advantages of Holiday Let Mortgages

Investing in holiday let properties offers significant benefits:

- Higher Rental Yields

Holiday lets typically charge higher weekly rents during peak times, making them a lucrative investment compared to standard buy-to-let properties.

- Tax Advantages

Owning a holiday let property may provide several tax benefits:

- Mortgage interest is deductible against rental income.

- Properties that qualify as furnished holiday lets (FHLs) may benefit from capital gains tax relief.

- Rental income from holiday lets counts as earned income, contributing to pension eligibility.

- Flexibility and Personal Enjoyment

You can enjoy your property for personal holidays while earning income when it’s let out.

- Portfolio Diversification

Adding a holiday let to your investment portfolio diversifies income sources and reduces risk.

Costs to Consider with Holiday Let Mortgages

Before securing a buy to let holiday home mortgage, it’s important to account for all associated costs:

- Interest Rates

Rates for holiday let mortgages can vary depending on the lender and the type of product chosen. Fixed-rate and variable-rate options are common.

- Arrangement and Application Fees

These fees are charged by lenders to process your mortgage.

- Valuation and Legal Fees

Property valuation fees and solicitor costs can add to upfront expenses.

- Maintenance and Operational Costs

Holiday properties often require frequent cleaning, furnishing, and upkeep to maintain standards.

- Insurance Costs

Specialist insurance is required for holiday let properties, covering risks such as short-term tenancies and potential void periods.

Holiday Let Mortgage Rates

Holiday let mortgage rates are influenced by factors such as:

- Loan-to-Value (LTV): Lower LTVs often result in more favourable rates.

- Rental Income Potential: Lenders assess the property’s ability to generate income.

- Interest-Only or Repayment Options: Choose between lower monthly payments with interest-only mortgages or building equity with repayment mortgages.

Use our mortgage calculator to to work out the best holiday rate for your circumstances and needs

Frequently Asked Questions

What defines a holiday let property?

A holiday let is a furnished property rented to holidaymakers on a short-term basis. It must be available to let for at least 210 days a year and let for a minimum of 105 days annually.

Can I live in a holiday let property?

You can use it personally for up to 90 days a year, but it must primarily serve as a rental property.

Are holiday let mortgages available to first-time buyers?

While it’s less common, some lenders may consider first-time buyers with a strong financial profile.

What’s the difference between a holiday let and a holiday home?

A holiday let generates rental income, while a holiday home is for personal use only and often funded with a residential mortgage.

Why Choose The Landlords Broker for Holiday Let Mortgages?

At The Landlords Broker, we specialise in helping property investors secure the best holiday let mortgages. Here’s why you should work with us:

Extensive Lender Network

We have access to competitive mortgage products from top lenders.

Expert Guidance

Our team offers tailored advice to meet your investment goals.

Simple Application Process

We handle the complexities of securing a mortgage, saving you time and effort.

Transparent Fees

We provide clear information on all costs, including interest rates and fees.

Start Your Holiday Let Investment Today

Whether you’re purchasing your first holiday let property or expanding your portfolio, our experts are here to help. Contact The Landlords Broker today to explore tailored mortgage options for your next investment.