Commercial and Semi-Commercial Mortgages: Tailored Solutions for Your Property Financing Needs

Whether you’re a property investor, business owner, or developer, finding the right mortgage for your commercial or semi-commercial property is crucial. At The Landlords Broker, we specialise in connecting you with flexible financing options to meet your specific goals. Our expertise ensures you receive competitive rates, clear advice, and a seamless application process.

What Are Commercial and Semi-Commercial Mortgages?

Commercial Mortgages

A commercial mortgage is a loan designed for properties used exclusively for business purposes. These mortgages are ideal for purchasing or refinancing commercial properties like:

- Offices

- Warehouses

- Retail units

- Industrial buildings

- Restaurants and pubs

Commercial mortgages typically cater to businesses and property investors, allowing them to secure larger loans with flexible terms.

Semi-Commercial Mortgages

A semi-commercial mortgage is specifically designed for mixed-use properties that combine residential and commercial spaces. Common examples include:

- Shops with flats above

- Guesthouses with living quarters

- Buildings with office space and residential units

These mortgages are suited for property owners who may operate a business from the premises while also utilising the residential portion or renting it out for additional income.

How Do Commercial and Semi-Commercial Mortgages Work?

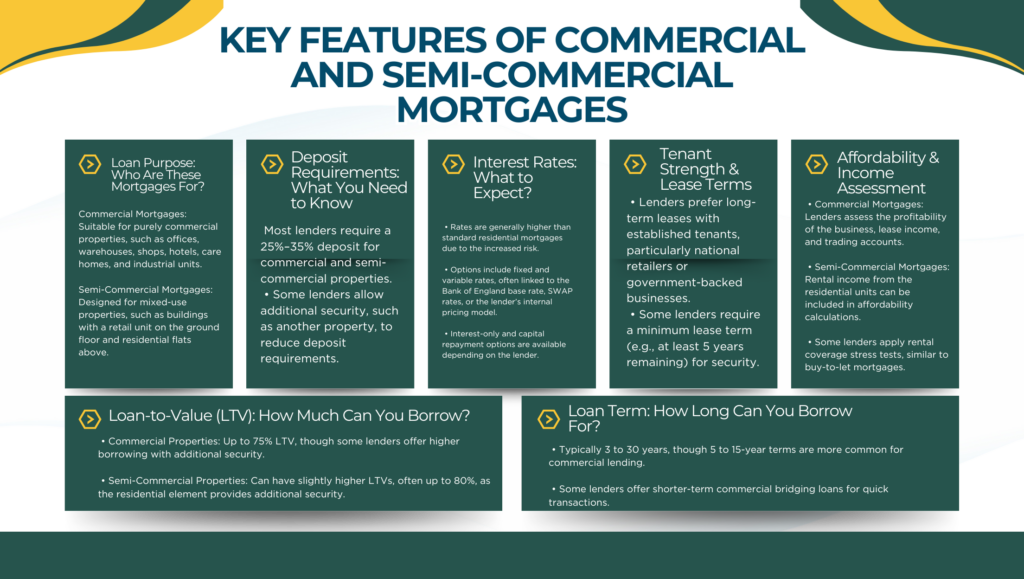

- Loan-to-Value (LTV):

- Lenders typically offer up to 75% LTV for semi-commercial properties and slightly less for purely commercial ones.

- Higher LTV may be possible with additional security or stronger borrower credentials.

- Interest Rates:

Rates for commercial mortgages typically range from 3% to 6%, while semi-commercial rates may vary slightly depending on the property mix and risk profile.

- Repayment Structures:

Options include interest-only mortgages, where you pay only the interest during the term, or repayment mortgages, which cover both interest and principal.

- Documentation Required:

- Personal and business bank statements (3–6 months).

- Proof of income and business accounts (usually 2 years).

- A business plan for owner-occupied properties.

- Application Timeline:

Expect the process to take between 6 and 12 weeks, depending on the lender and the complexity of your application.

Why Choose a Commercial or Semi-Commercial Mortgage?

These mortgages are ideal for:

Business Growth

Secure larger premises to support your expanding operations.

Mixed-Use Investments

Diversify income streams with a combination of residential and commercial rents.

Commercial Property Development

Fund property purchases, refurbishments, or new construction projects.

Property Acquisitions

Take advantage of opportunities like auction purchases or chain breaks.

Costs Associated with Commercial and Semi-Commercial Mortgages

Before applying, it’s essential to understand the costs involved:

Upfront Fees:

- Arrangement Fees: Typically 1%-2% of the loan amount.

- Valuation Fees: Costs depend on the property value and complexity.

- Legal Fees: Cover the lender’s and your solicitor’s services.

Ongoing Costs:

- Interest Payments: Rates vary based on fixed or variable options.

- Maintenance Costs: Especially relevant for mixed-use properties.

Exit Fees:

- Some lenders may charge fees for repaying the loan early or exiting the agreement.

Eligibility Criteria

Lenders will assess several factors when reviewing your mortgage application:

Credit History:

While perfect credit isn’t essential, a strong credit profile improves your chances of better terms.

Deposit:

You’ll typically need 25%-40% of the property’s value as a deposit.

Property Type:

Mixed-use or commercial-only properties require different levels of scrutiny.

Income and Financials:

Business financials and rental income play a significant role in determining eligibility and loan size.

Exit Plan:

A clear repayment strategy, such as refinancing or selling the property, is vital.

Benefits of Working with The Landlords Broker

At The Landlords Broker, we specialize in navigating the complexities of commercial and semi-commercial mortgages. Here’s what sets us apart:

Wide Lender Network

Access competitive rates from high-street banks, challenger banks, and specialist lenders.

Expert Advice

Our experienced brokers tailor solutions to your unique goals, whether you’re an investor or a business owner.

Streamlined Applications

We manage the entire process, from sourcing the best lender to handling the paperwork.

Transparent Costs

Clear explanations of fees, rates, and repayment terms so you can plan confidently.

Fast Approvals

With our expertise, we can help expedite your application, ensuring you meet tight deadlines.

Common Questions About Commercial and Semi-Commercial Mortgages

What’s the difference between a residential and semi-commercial mortgage?

A residential mortgage is for properties used solely for living, while a semi-commercial mortgage finances properties with both residential and commercial elements.

Can limited companies apply for these mortgages?

Yes, both commercial and semi-commercial mortgages are often available to limited companies.

How much deposit is required?

Typically, a deposit of 25%-40% of the property value is needed, depending on the type of mortgage.

Are these mortgages regulated by the Financial Conduct Authority?

Semi-commercial mortgages may be regulated if the residential component is occupied by the borrower, while most commercial mortgages are unregulated.

How do I find the best rates?

Use a commercial mortgage calculator to estimate costs, or work with a broker like The Landlords Broker to access tailored options.

Start Your Financing Journey Today

Whether you’re purchasing a commercial property, investing in mixed-use real estate, or refinancing your portfolio, The Landlords Broker is here to help. Contact us today for expert advice, competitive rates, and a smooth application process tailored to your unique needs.