Multi-Unit Freehold Block Mortgages: A Comprehensive Guide

A multi-unit freehold block mortgage (MUFB mortgage) is a specialised financial product designed for landlords or property investors managing properties with multiple self-contained units under a single freehold title. Whether you’re new to multi-unit investments or looking to refinance, these mortgages can simplify your property management and enhance rental yields.

What Is a Multi-Unit Freehold Block Mortgage?

A multi-unit freehold block mortgage is tailored for properties classified as multi-unit freehold blocks (MUFBs), which contain multiple self-contained units, such as flats, studios, or apartments, under a single freehold title. This type of mortgage provides flexibility and convenience, especially for property investors handling multiple tenants across units with shared facilities like kitchens and bathrooms.

Key Features of Multi-Unit Mortgages

- Comprehensive Coverage

A multi-unit mortgage allows you to manage the financing of all units within the property under a single loan, simplifying your financial structure.

- Property Versatility

These mortgages cater to a range of property types, including buy-to-let properties, converted houses, and blocks of flats.

- Higher Rental Yields

Properties with multiple tenants often generate higher rental yields than standard buy-to-let properties, minimising the impact of void periods on cash flow.

- Lending Flexibility

Lenders often consider the combined rental income from all units when assessing eligibility for multi-unit freehold block mortgages.

- Interest Rate Options

Choose between fixed or variable rates depending on your financial goals. Rates typically depend on property type, borrower profile, and the loan amount.

Benefits of Multi-Unit Freehold Block Mortgages

Here are some reasons landlords prefer portfolio mortgages over standard buy-to-let products:

Simplified Management

Manage one loan instead of multiple mortgages for each unit, reducing paperwork and administrative stress.

Enhanced Borrowing Power

Lenders often assess the overall performance of the property rather than individual unit profitability, enabling larger loan amounts.

Tax Efficiency

For properties owned under a limited company, these mortgages offer potential tax advantages, such as offsetting interest costs against profits.

Higher ROI

Multiple tenants generate consistent rental income, making these properties ideal for building a profitable portfolio.

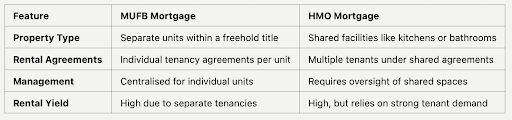

Multi-Unit Mortgages vs. HMO Mortgages

While similar in some respects, multi-unit freehold block mortgages differ from HMO mortgages.

Why Choose The Landlords Broker?

At The Landlords Broker, we specialise in multi-unit freehold block mortgages and tailored solutions for property investors. Here’s why clients trust us:

Wide Lender Network

Access to competitive rates from both high street and specialist lenders.

Expert Guidance

Comprehensive support through the mortgage application process, ensuring all requirements are met.

Tailored Solutions

Flexible options for mixed-use properties, large MUFBs, and limited company structures.

Transparent Fees

Clear breakdown of costs, including application and valuation fees.

Frequently Asked Questions

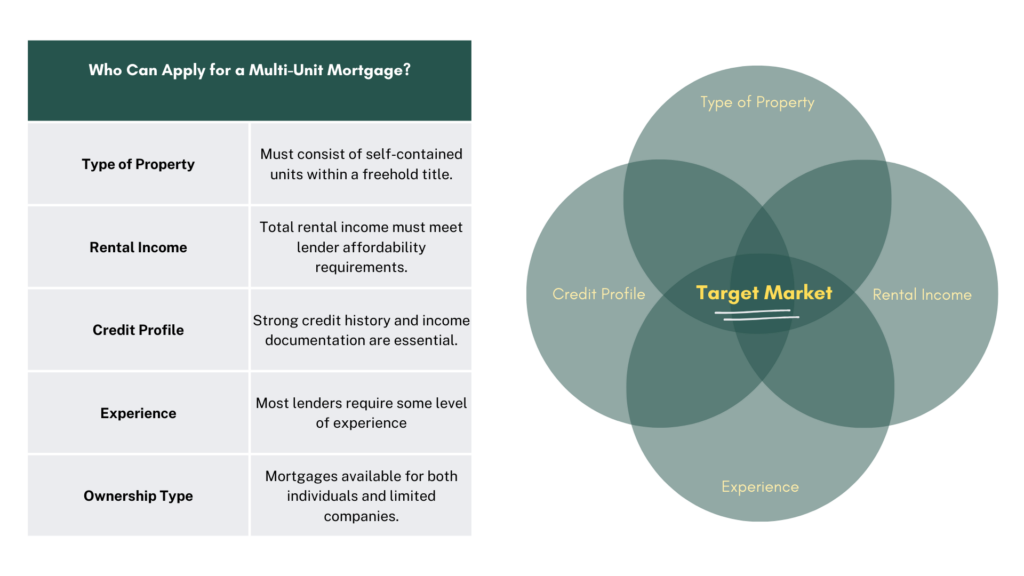

What properties qualify for a MUFB mortgage?

Properties with multiple self-contained units under one freehold title, such as blocks of flats or converted houses.

Can I apply through a limited company?

Yes, many lenders offer multi-unit mortgages tailored to limited companies.

How do lenders assess rental income?

Lenders evaluate the total rental yields across all units to determine affordability.

Are interest rates higher for multi-unit properties?

Rates may vary based on the property type and lender criteria, but they are often competitive with buy-to-let mortgage rates.

What is the maximum LTV for a MUFB mortgage?

Most lenders offer up to 75% LTV, though some may provide higher ratios for certain property types.

Start Your Multi-Unit Investment Journey

Whether you’re acquiring your first multi-unit property or expanding your portfolio, The Landlords Broker is here to guide you. Contact us today for expert advice and tailored mortgage solutions for multi-unit properties.