Understanding Property Taxes in the UK

Property purchases in England and Northern Ireland come with specific taxes that depend on your buyer status and property type. For most buyers, this tax is an important financial consideration, especially for first-time homeowners, buy-to-let investors, or those purchasing additional properties.

What is Stamp Duty?

Known officially as Stamp Duty Land Tax (SDLT), this is a government levy applied to property purchases over certain price thresholds. The amount owed depends on factors such as the property’s price, buyer type, and any surcharges for additional properties.

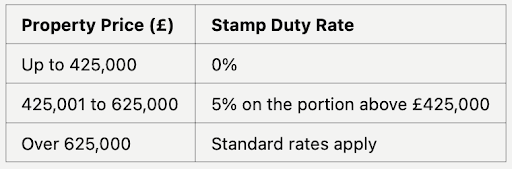

Tax Relief for First-Time Buyers

For those stepping onto the property ladder, first-time buyer relief makes purchasing a home more affordable. Buyers can benefit from reduced or zero tax on properties within specific price ranges:

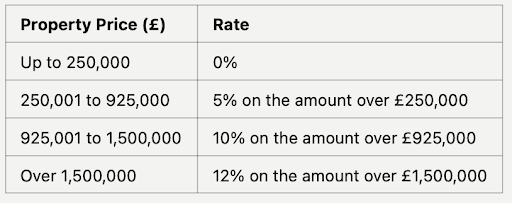

Buying a Primary Residence

If you’re purchasing a new home as your main residence, you’ll pay the standard property tax rates

Example: For a property priced at £400,000:

- The first £250,000 is tax-free.

- You’ll pay 5% on £150,000 = £7,500 in SDLT.

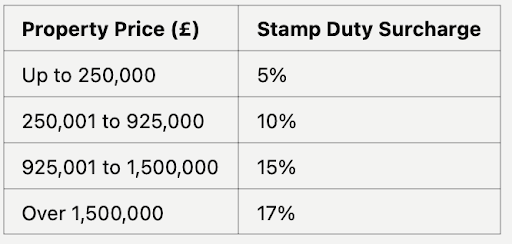

Additional Stamp Duty for Buy-to-Let Properties and Second Homes

As of the October 2024 Autumn Budget, a 5% surcharge now applies to additional property purchases, including buy-to-let investments and second homes. This is added to the standard rates above

Example: For a buy-to-let property priced at £300,000:

- The first £250,000 is taxed at 5% = £12,500.

- The remaining £50,000 is taxed at 10% = £5,000.

- Total SDLT = £17,500.

Estimating Property Taxes

Calculating your liability is straightforward with online tools. A property tax calculator allows you to quickly determine the exact amount you’ll owe, based on the purchase price and buyer type.

Key Points for Buyers

Several factors determine BTL mortgage interest rates:

First-Time Purchases

Relief available for properties up to £425,000.

Primary Homes

Standard rates apply without additional surcharges.

Buy-to-Let

A 5% surcharge increases total liabilities for landlords and investors.

Timely Payments

The tax must be settled within 14 days of purchase completion.

FAQs About Property Taxes

How much tax will I pay as a first-time buyer?

You’ll pay nothing on homes up to £425,000, and 5% on the portion between £425,001 and £625,000.

What are the rates for additional properties?

A 5% surcharge applies to buy-to-let properties or second homes, on top of standard rates.

How do I calculate my property tax liability?

Use an online calculator or consult with a broker to estimate your total tax based on the property price and your buyer status.

Is this tax mandatory?

Yes, it’s required for all eligible property purchases, with penalties for late payment.

Are there exemptions for non-residents?

No, non-residents face an additional 2% surcharge on top of standard rates and surcharges for additional properties.

Tailored Advice and Tools

Navigating property taxes can feel complex, but we’re here to help. At The Landlords Broker, we offer expert advice and access to tools like a property tax calculator to make the process seamless.

Contact us today to explore your options and plan your next property purchase with confidence.